Buy-to-Let Understanding High Fees

Understanding the Fees Behind Buy-to-Let Mortgages: Why They Might Not Be as Bad as They Seem

Buy-to-let mortgages can feel like a labyrinth, especially when confronted with what seems like high 'rip-off fees.' But why are these fees so steep? and could they sometimes work in your favor? Find out the reasons behind these fees and provide examples to help you make informed decisions.

With the Bank of England base rate set at 5.25% and some buy-to-let mortgages as low as 4.00%, it's clear a fee has to be charged for it to make financial sense for the lender.

The maximum loan that a mortgage lender is willing to offer can be determined based on rent and the interest rate charged. This is an affordability test mandated by regulators. It does consider other factors, but these are the main two.

Buy-to-let mortgage rates can be lower than what a bank could borrow itself to help landlords pass regulatory affordability tests. However, this is not due to generosity; rather, it is a result of charging fees on top, which creates this loophole.

Mortgage Fees & Rate Examples

In the examples below, we use Kensington Mortgages Free Valuation products for 5-year Fixes at 75% LTV, borrowing £200,000 via a Limited Company SPV purchasing a standard BTL Property. With a rent of £1,200

5% Fee with 4.69% Rate

- £46,900 Total Mortgage Payments

- £10,000 Fee Paid Upfront

- £56,900 True Cost after 5 Years

- £245,628 Max Borrowing based on Rent

3% Fee with 5.09% Rate

- £50,899 Total Mortgage Payments

- £6,000 Fee Paid Upfront

- £56,899 True Cost after 5 Years

- £226,326 Max Borrowing based on Rent

0% Fee with 6.44% Rate

- £64,399 Total Mortgage Payments

- £0 Fee Paid Upfront

- £64,399 True Cost after 5 Years

- £178,881 Max Borrowing based on Rent

Observations..

In the last example, although you aim to borrow £200,000, due to rent and regulatory affordability tests, your maximum borrowing would be limited to £178,000. This showcases why high-fee products can sometimes secure loan approval where lower-fee products cannot.

You can now see why the High-Fee Products Exist; they're often the difference between a mortgage being declined or not.

You do not want to take from this that the Higher-Fee Products are better, but remember that they can open doors.

How do Products Compare over Larger Loans

If you want to learn how to choose the best mortgage, look at the "True Cost" instead of the Rates and Fees. This is the figure that informs you the best mortgage over a period of time inclusive of rates and fees.

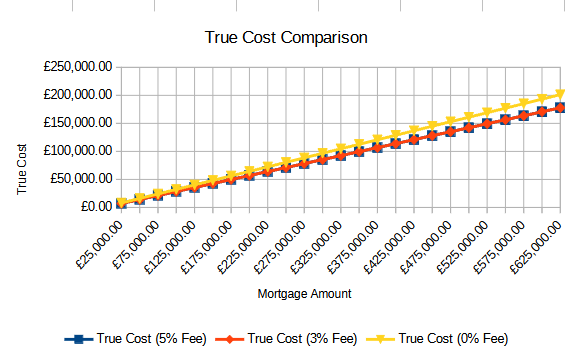

Based on the graph, it's evident that both the combination of a 5% fee with a 4.69% rate and a 3% fee with a 5.09% rate result in approximately the same True Cost. It seems as though the mortgage lender intentionally structured the products with a profit margin in mind.

Unfortunately, in this example, the Fee-Free Product is running away with its high mortgage rate of 6.44%. The higher the mortgage loan, the more expensive it is over the 5-year Term compared to the fee options. It seems the lender structured the product to be competitive at low mortgage amounts but not with larger loans.

This is one example, and these trends are for this product selection only. There is often a loan amount tipping point when one product is better than the others.

Adding Fees

In the examples above, we showed the fee being paid upfront out of your savings, but it can often be added to the loan. In the 5% fee example above, adding the fee would have resulted in an extra £2,356 in mortgage payments, as the mortgage loan would be £210,000 instead of £200,000.

NOTE The £1,200 rent figure was used for illustrative purposes as an average UK rent, rather than the rent that would be expected for a property of similar value.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX