First Time Buyer Mortgages

We love to assist first-time buyers in obtaining the keys to their first home. If you don't know where to start or what is required, give us a call for a free review and guidance.

Owning your first home is fun! Buying your first home can be stressful.

You don't have to figure it out by yourself. Our First Time Buyer Advisers will help you find the best mortgage deal, explain the different options and assist you in every stage of your homebuying journey.

A first-time buyer is someone who either has never owned a home or is not currently a homeowner. It's important to note that some mortgage schemes are exclusively available to those who have never owned a home before, or haven't owned one for a specific period of time.

🏠Saving or deposit requirements for first-time homebuyers.

Talk to us about your savings/guarantor, even if you're just starting to save.

How much Savings does a First-Time Buyer need?

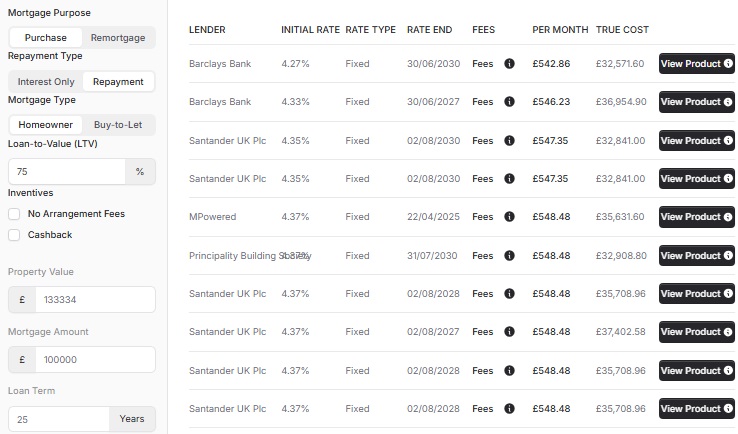

You want to provide as much deposit as possible to reach the lower Loan-to-Value (LTV). If you have savings starting at 1% of the property value, we can help you, but you will pay higher mortgage rates than someone with savings of 5% of the property value.

First-Time Buyer Mortgages with Guarantor

We offer mortgages for First-Time Buyers—a 99% LTV and a 95% LTV. If you have your own savings, you may qualify for either of these mortgages. However You can still get a Lower Loan-to-Value Mortgage by using a Guarantor. A Guarantor is a parent or a loved one who owns their own home. They can help you by using their property as collateral for your mortgage.

🏠Affordability for First-Time Buyers

Let's use our affordability calculator to determine your target property value range.

The maximum amount of mortgage that you can get relies on the income that you can demonstrate to a bank. This income can be generated from various sources such as PAYE income, self-employment income, and other forms of income including Universal Credit payments like Family Tax Credits.

Having existing credit commitments such as car loans, personal loans and credit cards can reduce the available mortgage amount.

🏠Talk to our First Time Buyer Mortgage Advisers

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX