Home Owner Remortgage

The best place to remortgage simpler, clearer, faster

Challenge us to get a better mortgage than your current lender provides

You can remortgage for various reasons, and we're here to make it easier for you. We have access to your current lender's mortgages and many more besides. This enables us to get you the best mortgage for your circumstances.

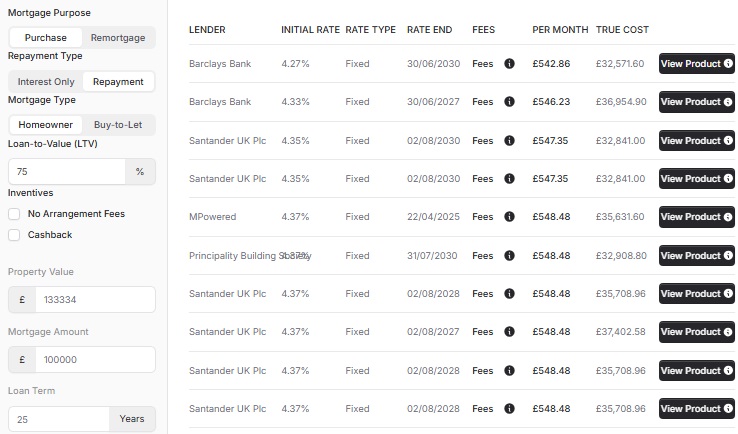

Lowest Homeowner Remortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

3.78%

2 Year Fixed

TBC

TBC

Fixed

at

3.78%

|

|

|

|

3.78%

2 Year Fixed

TBC

TBC

Fixed

at

3.78%

|

|

|

|

3.79%

2 Year Fixed

TBC

TBC

Fixed

at

3.79%

|

|

|

|

3.79%

2 Year Fixed

TBC

TBC

Fixed

at

3.79%

|

|

|

|

3.79%

2 Year Fixed

TBC

TBC

Fixed

at

3.79%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £142858 property value, a £100000 loan amount and £42858 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

3.78%

2 Year Fixed

TBC

TBC

Fixed

at

3.78%

|

|

|

|

3.78%

2 Year Fixed

TBC

TBC

Fixed

at

3.78%

|

|

|

|

3.79%

2 Year Fixed

TBC

TBC

Fixed

at

3.79%

|

|

|

|

3.79%

2 Year Fixed

TBC

TBC

Fixed

at

3.79%

|

|

|

|

3.79%

2 Year Fixed

TBC

TBC

Fixed

at

3.79%

|

|

The mortgage products shown are for illustrative purposes only and were generated 1 second ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £133334 property value, a £100000 loan amount and £33334 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

3.99%

5 Year Fixed

TBC

TBC

Fixed

at

3.99%

|

|

|

|

3.99%

5 Year Fixed

TBC

TBC

Fixed

at

3.99%

|

|

|

|

4.01%

2 Year Fixed

TBC

TBC

Fixed

at

4.01%

|

|

|

|

4.01%

2 Year Fixed

TBC

TBC

Fixed

at

4.01%

|

|

|

|

4.04%

2 Year Fixed

TBC

TBC

Fixed

at

4.04%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £125000 property value, a £100000 loan amount and £25000 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

3.99%

5 Year Fixed

TBC

TBC

Fixed

at

3.99%

|

|

|

|

4.01%

2 Year Fixed

TBC

TBC

Fixed

at

4.01%

|

|

|

|

4.05%

2 Year Fixed

TBC

TBC

Fixed

at

4.05%

|

|

|

|

4.05%

3 Year Fixed

TBC

TBC

Fixed

at

4.05%

|

|

|

|

4.05%

5 Year Fixed

TBC

TBC

Fixed

at

4.05%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

4.14%

5 Year Fixed

TBC

TBC

Fixed

at

4.14%

|

|

|

|

4.24%

5 Year Fixed

TBC

TBC

Fixed

at

4.24%

|

|

|

|

4.24%

5 Year Fixed

TBC

TBC

Fixed

at

4.24%

|

|

|

|

4.44%

5 Year Fixed

TBC

TBC

Fixed

at

4.44%

|

|

|

|

4.44%

5 Year Fixed

TBC

TBC

Fixed

at

4.44%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £111112 property value, a £100000 loan amount and £11112 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.22%

5 Year Fixed

TBC

TBC

Fixed

at

5.22%

|

|

|

|

5.25%

5 Year Fixed

TBC

TBC

Fixed

at

5.25%

|

|

|

|

5.38%

5 Year Fixed

TBC

TBC

Fixed

at

5.38%

|

|

|

|

5.41%

5 Year Fixed

TBC

TBC

Fixed

at

5.41%

|

|

|

|

5.58%

2 Year Fixed

TBC

TBC

Fixed

at

5.58%

|

|

The mortgage products shown are for illustrative purposes only and were generated 41 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £105264 property value, a £100000 loan amount and £5264 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

10 Reasons to Remortgage

Talk to us about your reason to remortgage.

1 ) Lower your Mortgage Rate

Nationwide every month over 16,000 sales are "Simple Refinance". These homeowners refinanced for no other reason except to lower their mortgage payments.

You can lower your mortgage payments by reducing the Interest Rate. A typical mortgage has an "introductory interest rate" of two to five years. After that time the Interest Rate increases to a "Standard Variable Rate (SVR)". Your mortgage payment increases!

Your mortgage lender will offer you a retention mortgage product before then. These mortgages are not often competitive against their own mortgage range. In addition to the 80+ other mortgage lenders remortgage products.

Research from Which? Shows that remortgaging can save £4,000 a year compared to staying on a Standard Variable Rate (SVR).

You can remortgage with us. We compare your current mortgage to other lenders (and your current one). Switch you to a healthier mortgage rate to reduce your monthly expenditure.

NOTE: Lowering the Interest paid does not affect how soon you repay your mortgage. Except you could use the extra cashflow to overpay the capital or reduce your mortgage term.

2 ) Extend your Mortgage Term

The duration in years until your mortgage is paid off is the "Mortgage Term".

When remortgaging, you can extend your mortgage term. Extending the term has the benefit of your payments being lower. With the disadvantage of increasing the years until you are mortgage-free.

You will pay less now but over the term of the mortgage pay more, compared.

It can be helpful if affordability is tight. Lower mortgage payments enable increased personal cashflow. Money to use on other things, such as general day-to-day costs or investing in a business.

Your retirement age limits maximum mortgage term. However, some lenders criteria are more liberal.

You can remortgage with us. We compare your current mortgage to other lenders (and your current one). Switch you to a mortgage term that fits your requirements.

3 ) Reducing your Mortgage Term

When remortgaging, you can decrease your mortgage term. Reducing the mortgage term has the benefit of you paying off the mortgage earlier. With the disadvantage of having higher mortgage payments every month.

It can be helpful if you have excess income and plan to retire early or be mortgage-free sooner.

You will pay more now but over the overall term of the mortgage pay less, compared.

An affordability assessment will determine the lower limit of the mortgage term.

You can remortgage with us. We compare your current mortgage to other lenders (and your current one). Switch you to a mortgage term that fits your requirements.

4 ) Switch to Interest-Only Mortgage

If your mortgage is currently on a Repayment basis, this means that by the end of your mortgage term. You will be Mortgage-Free!

You may prefer an Interest Only basis mortgage. Where monthly payments only cover the Interest charged. You do not reduce the capital mortgage loan outstanding.

Interest Only Mortgages have the benefit of lower monthly payments. With the disadvantage of at the end of the term having an outstanding mortgage. That still needs to be repaid in full.

To be eligible for an Interest Only Mortgage. The amount of mortgage outstanding needs to be at 60% of the value of your home (60% LTV).

Besides, you need also to have a repayment strategy. You could, for example, propose to repay the mortgage by selling property(s) you own (2nd home or Buy-to-Let Properties), or Mortgage Endowment Policy, or Savings, Stocks & Shares Investment Portfolio, Trust Fund, Personal Pension or similar.

You can remortgage with us onto Interest Only. We compare your current mortgage to other lenders (and your current one). Switch you to an Interest Only Mortgage that fits your requirements.

5 ) Switch to a Repayment Mortgage

In the past Interest Only Mortgages used to be very common. Many have no viable repayment strategy.

Interest Only Mortgages can be dangerous. You have to repay the outstanding in balance when the mortgage term ends. To do this, you will need to refinance (at an older age), sell the property or find money from other sources to repay it.

You can change to a repayment mortgage. The advantage of this it guarantees that your home will be mortgage-free at the end of the mortgage term. With the disadvantage of higher monthly payments.

The younger you are the longer your mortgage term can be. Enabling payments to be smaller. Switching to a Repayment Mortgage near retirement age results in larger mortgage payments, compared.

You can remortgage with us onto Repayment. We compare your current mortgage to other lenders (and your current one). Switch you to a Repayment Basis Mortgage that fits your requirements.

6 ) Remortgage for Additional Borrowing

We use the fancy term of "releasing capital". What you are doing is increasing your outstanding mortgage. The money from the increase in the mortgage loan goes into your bank account.

You can use the funds for many purposes such as; Home Improvements (such as an extension), Debt Consolidation, Buy a 2nd Home, Invest in Buy-to-Let or any other legal purpose.

The reason why you want to increase Borrowing is a factor in many mortgage lenders criteria. Many lenders have prescript reasons for why they will allow Additional Borrowing.

You will be increasing your indebtedness. It is not free money and will mean higher monthly mortgage payments.

It is possible to limit the increase in mortgage payments by other means, such as extending the mortgage term or switching to a better rate.

7 ) Remortgage to Decrease Borrowing

Could the savings in your bank account be put to better use?

The Interest Banks pay you on savings is currently minimal. Compared to the Interest charged on your mortgage.

Reducing the outstanding mortgage on your home will increase your monthly cash flow. Due to Interest now charged on a lower outstanding amount.

A reduction in a mortgage can also reduce your Loan to Value (LTV) bracket. Producing better mortgage product options at lower mortgage rates.

Mortgages often have an Overpayment Allowance. Allowing you to overpay your mortgage by a percentage any time. Though if your initial mortgage rate has come to a close. You can refinance and reduce the outstanding loan by any amount at the same time.

You can remortgage with us and reduce your Borrowing. We compare your current mortgage to other lenders (and your current one). Switch you to a lower mortgage that fits your needs and requirements.

8 ) Remortgage to repay Help-to-Buy

The Help-to-Buy scheme enabled many to get on the property ladder. It does not have to be paid back until the end of your mortgage term or when you sell the property. It is also often viewed as cheap finance.

Except there is a hidden cost in Help-to-Buy in that the Government owns a stake in your home. That means when you come to sell the property or repay the loan. The Government will want their percentage stake back. That includes any increase in the value of your home.

If you took out a 20% equity loan on the house then worth £100,000 they Help-to-Buy lent you £20,000. If that house is now worth £120,000 they will want back £24,000. This is on top of the Interest you have been paying them.

The option is yours, but the consensus is that property rises in value. If not now, almost definitely by the end of your mortgage term (say 25 Years). So it could be better to repay the Government Stake in your property sooner rather than later.

9 ) The value of your home has increased.

When you first purchased your home, you provided a deposit—presumably money from your savings. An increase in the value of a home increases the amount of "deposit" or what we now call "equity".

The equity in your home also increases month-on-month (if you are on a repayment mortgage). You have been paying down the outstanding mortgage debt during this time.

When you remortgage, you may find you can now have a lower Loan to Value (LTV) bracket. Eligible for much lower mortgage rates than you were.

You can remortgage with us. We compare your current mortgage to other lenders (and your current one). Switch you to a lower mortgage rate that reflects your new Loan to Value (LTV).

1 0) You're worried about rising interest rates

We dont know how interest rates will rise or fall. If It is the Base Rate (to fight inflation) or Bank Rates based on wholesale financial markets.

You may hear predictions on the news from time to time or a feeling in your gut. With mortgages, you can protect yourself from any immediate rises in interest rates.

We do this with Fixed-Rate Remortgages. The most common is a 2-Year Fix, though there are longer terms from 5 to 10 years.

During that time, the interest rate stays the same. You will have the certainty of what your mortgage payments will be without the worry that rising interest rates.

The disadvantage is that it does lock you in for that period. If you wish to sell the home or refinance in that term, you will have to pay an Early Repayment Charge (ERC).

You can remortgage with us. We compare your current mortgage to other lenders (and your current one). Switch you to a fixed-rate mortgage to protect against interest rate rises.

🔷Should you remortgage?

The answer is not always Yes, talk to us about how and when to remortgage.

We have gone over the reasons to remortgage, but even if one of those reasons is desirable. It may not be the best route given your needs and circumstances.

You can contact our Mortgage Advisers, to work through the advantages and disadvantages. We can help you determine if it is right for you.

Some things to think about is:

- It is too much work! We are here to make it easy for you, but it does involve some paperwork and getting us the documents required. We dont pretend It is fun, but it can save you money. Those savings used to fund the fun stuff.

- It is too expensive! There can be fee's involved such as Valuation Fees, Solicitor Fees and other costs. However, we do have Fee Free options available. You also need to compare the upfront costs to the potential savings from remortgage over the longer term.

- I have an Early Repayment Charge (ERC)! You may need to pay a fee to your current lender to leave them if you are still in the initial rate. Depending on your circumstances at the time and the interest rate your paying. It could even be net positive, and we can help you calculate this.

- My home value has fallen! If the equity in your home has decreased. Remortgaging can mean you fall into a higher Loan to Value (LTV) Bracket. Higher LTV can mean more expensive mortgage rates, but It is always worth a check with a broker. As SVR's are often more costly.

- I have had credit problems! It is more challenging to find mortgage options when you have had missed payment, CCJ's, etc.. Though we do have some lenders that will look consider your circumstances.

- I already have a Low Mortgage Rate! A few homeowners have some fabulous old mortgage products. These could be desirable mortgage rates by today's standards. It is possible that remortgaging mean higher payments. We can work this out for you, so dont hesitate to compare and contrast.

- I'm planning on moving! If you are soon to look at selling your current home. Remortgaging can fix you into a new mortgage term, with Early Repayment Charges (ERC). However, we do have porting products available and mortgages without ERC's.

🔷Talk to our Remortgage Advisers

-

Buy-to-Let Mortgage

>

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Buy-to-Let Remortgage

>

Maximize your investment with Buy-to-Let Remortgage, ensuring optimal returns by refinancing your property portfolio with competitive rates.

-

Buy-to-Let Rate Switch

>

Enhance your property investment strategy with a Buy-to-Let Rate Switch, ensuring you stay competitive in the market with a smart financial move.

-

Buy-to-Let Company Mortgage

>

Optimize your property portfolio's potential with a Buy-to-Let Mortgage in your SPV Company Name, combining strategic investments with simplified financial structures.

-

Portfolio Mortgages

>

Grow and diversify your property portfolio with our Portfolio BTL Mortgages, offering tailored solutions for seasoned investors aiming for prosperity.

-

Holiday Let Mortgage

>

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

HMO Mortgage

>

Unlock the potential of shared living spaces with our HMO Mortgage, tailored to support your investment in Houses in Multiple Occupation.

-

HMO Company Mortgage

>

Elevate your HMO investment strategy with our HMO Mortgage in your SPV Company Name, combining strategic planning with streamlined financial structures.

-

HMO Remortgage

>

Revitalize and optimize your HMO investment with a strategic HMO Remortgage, ensuring your shared living spaces remain lucrative in the market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX