How to Lower your Monthly Mortgage Payments!

Lower your monthly payments, but at what cost?

With inflation increasing the cost of everything from food to your mortgage, we can offer you a way to lower your Monthly Mortgage Payment, but it has long-term implications.

Due to its immediate relief on monthly repayments, one increasingly popular concept is extending your mortgage term when you remortgage. But does it truly offer a beneficial payoff in the grander scheme?

Extending Your Mortgage Term

Mortgage term extension refers to increasing the time you take to pay off your mortgage. Most mortgages in the UK tend to run for about 25 years, but they can be shorter or much longer. Extending your mortgage term effectively reduces your monthly repayments as you choose to repay the mortgage over a lengthier period.

The Benefits

Lower Payments

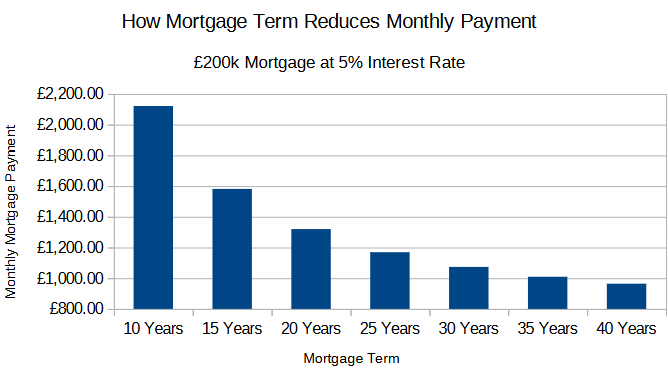

The key benefit of extending your mortgage term is immediate: it reduces your monthly mortgage repayments and improves cash flow.

If you have a £200,000 mortgage at 5% interest, your monthly payments would be £1,319.91 for a 20-year term and £964.39 for a 40-year term, giving you an extra £355.52 in disposable cash.

Affordability

If you already have a mortgage and your fixed-rate mortgage is ending and interest rates have risen, expanding your mortgage term can help maintain affordability.

For First Time Buyers, a longer mortgage term can be the difference between a declined or accepted mortgage.

The Drawbacks

Increased overall cost

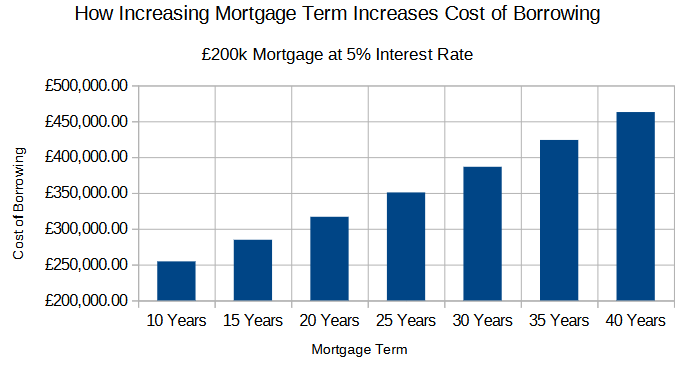

Although you pay less each month when you extend your mortgage term, you pay more due to the increased interest that accrues over time.

If you have a £200,000 mortgage at 5% interest, you would pay a total of £316,778.75 over 20 years and £462,908.74 over 40 years. Opting for the longer mortgage term, therefore lower monthly payments, would cost you an additional £146,129 over the life of the mortgage.

In Debt for Longer

If you increase the mortgage term, it will take longer for you to repay your mortgage. This has to be taken into consideration with your life plans and goals. A longer term may require you to delay retirement to ensure you have the income to fund the mortgage payments.

Lender's Criteria

Lenders impose restrictions on term extensions. They have criteria that limit the maximum term, and age restrictions ensure mortgages are paid off before retirement.

Maximum term limit

Typically, lenders in the UK will offer mortgage terms up to a maximum of 35 years. However, this can vary, and coupling this with an age limit can limit your term extension options.

Age limits

Most lenders have an upper age limit beyond which they will not allow a mortgage term to go beyond. This age limit is based on your anticipated retirement age and what is typical for someone doing your job. This limit is usually around 70-75 years but can differ from lender to lender.

It is not permanent

You have the flexibility to change your mortgage term at any time, although doing so when you remortgage can help you avoid fees.

Extending your mortgage term is an option if you're feeling the pinch due to high interest rates. Once you receive a pay raise or pay off your student loans, you may find that your budget can handle a shorter mortgage term.

Is Extending Your Mortgage Term Right For You?

Extending your mortgage term might look attractive due to the reduced monthly payments, but this decision should not be taken lightly. Before making any decisions, it's essential to consider your circumstances, financial health, and future prospects and talk with a mortgage expert.

Consider contacting our team of professionals for personalised advice based on your unique mortgage needs. We can help you better understand the long-term implications of extending your mortgage term and guide you in making informed decisions about your mortgage.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX