85% LTV Buy-to-Let Mortgage

The lowest deposit you can put down to buy a Buy-to-Let is 15% of the property value.

While homeowners may obtain 95% LTV mortgages, landlords are limited to 85%, the highest LTV available for property investors, including remortgages.

In 2024, it is uncommon to find a Buy-to-Let lender offering mortgages to landlords with only a 15% deposit. Kent Reliance (KRBS) and Kensington used to have such mortgage products, but not anymore, leaving very limited options.

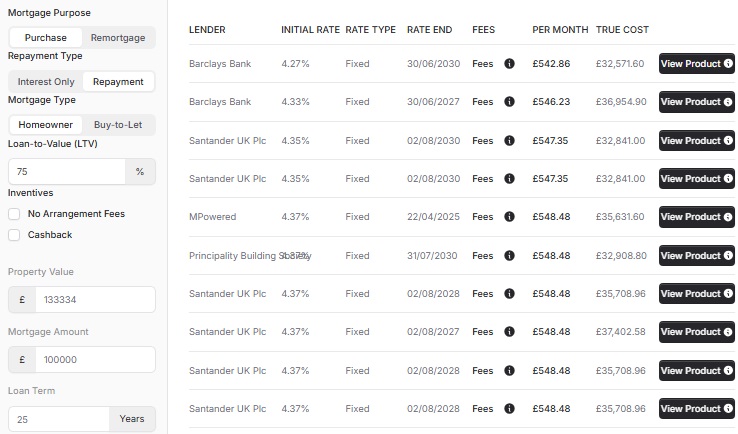

Lowest 85% LTV BTL Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 7 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 7 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 17 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

An 85% loan-to-value (LTV) enables landlords to remortgage their property and release capital at the highest LTV percentage, allowing them to use the funds in other areas of their property investment business. Additionally, the 85% LTV purchase option enables experienced landlords to acquire a property or multiple properties using a lower amount of their savings.

Can I buy or remortgage with just 15% deposit :

- in a LTD Company? Yes.

- in my personal name? Yes.

- a standard rental? Yes.

- an HMO? Yes.

- an MUFB? Yes.

- an Holiday Let? No.

Affordability

The affordability of a Buy-to-Let Mortgage depends on the potential rental income. Landlords may struggle to meet an 85% loan-to-value (LTV) rental stress test. Opting for a 5-year Fixed Rate and purchasing property through a Limited Company can lead to more favourable rental stress test outcomes.

For illustrative purposes only: on an LTD Company Mortgage with a 5-year Fix, when buying a £100,000 property with an 85% LTV Mortgage (£85,000), you would need £583.49 in rent.

A rough calculation suggests that for every £1,000 borrowed,

- you must show evidence of £6.89 in rent (5-Year Fix, in LTD Company).

- you must show evidence of £8.02 in rent (2-Year Fix, in Personal Name as Higher Rate Taxpayer).

This affordability requirement is higher than what is needed at lower loan-to-value (LTV) brackets.

Mortgage Rates

With limited options for 85% loan-to-value (LTV) mortgages, you will typically face higher mortgage rates. However, for many landlords, it can still help them achieve their goals.

We always recommend having the plan to save funds to reduce your mortgage amount after the initial fixed-rate or using the up to 10% overpayment allowance in any rolling 12-month period.

Opting for a higher loan-to-value (LTV) mortgage comes with higher interest rates. However, increasing your deposit by just 5% can secure you better rates, and a 10% increase can significantly lower them. High LTV mortgages are ideal for landlords who are comfortable with substantial leverage.

Instead of spending the additional deposit difference on luxuries like holidays or flashy cars. It would only make sense to consider using the funds for multiple property purchases, developments, improvements, extensions, or conversions to make your money work harder.

Mortgage Rates

- 2-Year Fixed 6.64%, 2% Fee

- 2-Year Fixed 6.89%, 2% Fee for HMOs & MUFBs

- 5-Year Fixed 6.59%, 2% Fee

- 5-Year Fixed 6.69%, 2% Fee for HMOs & MUFBs

Note: The 2% of mortgage fee must be paid out of savings, it can not added onto the 85% LTV loan amount.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX