Day-1 BTL Remortgage

Often overlooked, Day One Remortgages are a rapidly growing trend in property investment.

What is a Day One Remortgage?

A Day-One Remortgage is a lending facility used when a property investor refinances a property soon after it has been purchased. Typically used after auction purchase or by landlords to build portfolios by bringing bad housing stock into use and increasing the value.

Day One Remortgage often benefits landlords looking to increase their property portfolio quickly.

Why Remortgage after one day?

It's more of an idiom, and refers to the time shortly after a purchase. Its not typical to remortgage a day after purchase but a few weeks or typically a few months.

Quick Purchase We help landlords who buy properties from sellers who need a quick sale, such as meeting auction deadlines. Property investors often use cash or bridging finance to make purchases quickly. Now, they want to repay the bridge to exit high rates or get their cash back into a bank account ready for their next investment.

Unmortgagble or Light Works Required You can not get a Standard Buy-to-Let (BTL) Mortgage if the property is not habitable. This often results in Landlords buying a property with Bridging Finance, quickly replacing a kitchen or bathroom and needing to remortgage as soon as possible to get off of Bridging Finance mortgage rates.

Lease Extention You cannot use a standard Standard Buy-to-Let (BTL) mortgage to buy a leasehold property if the lease has only a few years remaining. Landlords have found that working with the seller to initiate the lease extension, purchasing with bridging finance, and then remortgaging once the lease is extended can add value to a property.

How is the property valued?

The value of the property you purchased a day or even a month ago is its value. It did not increase in value just because you now own it.

This means that to get an uplift in value, lenders are looking for evidence that you have completed the work on the property. Such as changing it from uninhabitable, therefore unmortgageable, to habitable.

Case Study

For example, a landlord buys a property at £100,000 on 1 January 2024. Over the next two months, they work on the property, increasing its value to £125,000.

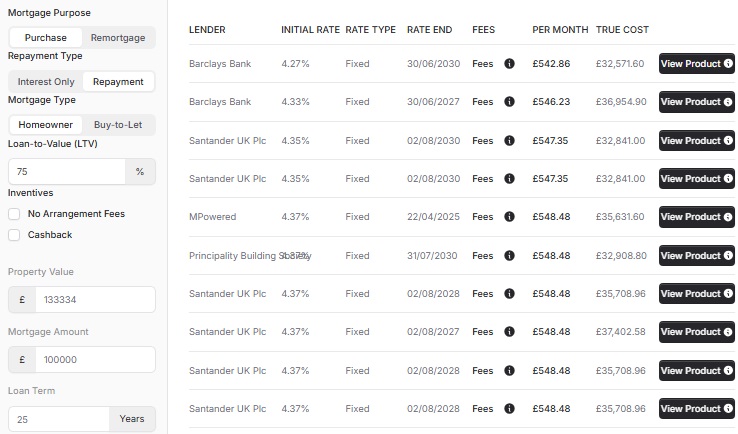

Some lenders will only value it at £100,000 until six months later ("The Six Month Rule"), while others will see the property's value as £125,000. Here are a few examples:

-

Fleet Mortgages & Vida, would lend at the New Purchase Price of £125,000 as works have been completed.

-

Foundation Mortgages, would need the landlord to own the property for 3 months if purchased with bridging and 6 months if purchased with cash.

-

Kent Reliance & Paragon, would consider the £125,000 purchase price if the Landlord can evidence "significant improvements" via a Schedule of Works but in all instances, the property must be shown as owned at the Land Registry.

-

Zephr will only use the lower of the Purchase Price or Open Market Value, meaning just £100,000.

-

BM Solutions, Coventry/Godiva, Leeds Building Society & many more do not allow remortgages within six months of purchase (some exceptions, like inherited properties).

-

Accord Mortgages & many more, require the property to be owned for 12 months.

Day-1 Remortgage Disadvantages

The number of lenders offering Day-1 Remortgages are relatively low, resulting in a lack of competition to drive down mortgage rates.

Many mortgage lenders are not fond of "back-to-back" transactions, and some have a "Six-Month Rule." This is because in the past, lenders have made mistakes and lost money due to these types of transactions. It is expected that the number of lenders offering Day-1 Remortgage facilities will decrease in a financial downturn.

Landlords should be careful when making renovations as not all improvements will increase the value of the property. Simply painting and decorating may not add significant value, and investing in an expensive new kitchen is unlikely to raise the value above the average price for similar houses in the area. While increasing the livable space is the most effective way to add value, the costs involved in doing so can sometimes exceed the value it adds.

Some, Small Print

Not all lenders will take into account an increase in value. Some will only consider the original purchase price, while others may add a portion of the renovation costs to the purchase price, and some will consider the updated market value. It's important to collaborate with your mortgage adviser to determine the approach that a particular lender takes.

Lenders want to ensure the sale is not unethical (for example, a distressed vendor sale), which would preclude many lenders from lending.

Some lenders may not offer a remortgage until you are listed as the owner on the Land Registry, which can take several months. However, "Day-1" lenders can use the TR1 form from your conveyancing solicitor. It's best to work with your mortgage adviser to determine which lenders offer this option.

Role of a Mortgage Adviser

We are here to help you secure the best mortgage. Our knowledge of mortgage lender criteria and limits makes it easier for us to get your Day-1 remortgage approved. We are here to help you navigate these complex decisions.

Day-1 Remortgage Alternative

If you need a quick sale, you can work with a good mortgage broker to make it happen swiftly. We are always constrained by the time it takes a lender to underwrite a case and for conveyancing solicitors to conduct their checks. A normal Buy to Let purchase is usually the best option if the seller is giving you enough time.

If the property is unmortgageable, there are few alternatives other than purchasing with cash or using bridging finance. Collaborating with the seller to repair the property is an option, but it comes with risks and complications.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX