Today, the Office for National Statistics (ONS) revealed that the inflation rate in the UK has dipped to 2.3% a remarkable low point unseen in the past three years. A decrease from 3.2% just a month ago, this might carry some heavyweight implications for first time home buyers and homeowners with mortgages.

On this occasion, seeing inflation go down towards the 2% target set by the Bank of England is big news. It generally implies that the Central Bank may need to start stepping back by possibly lowering the Bank Base Rate, ensuring that inflation doesn't shoot past its target. The Bank Base Rate is a crucial factor pushing mortgage costs higher as the bank has been striving to keep inflation in check around 2%.

This latest development is a positive sign for those of you with expiring fixed-rate mortgages or for first-time homeowners looking to step onto the property ladder. You might remember UK Prime Minister Rishi Sunak promising to "halve inflation"; this significant drop in inflation is a clear success for him as we head towards an election.

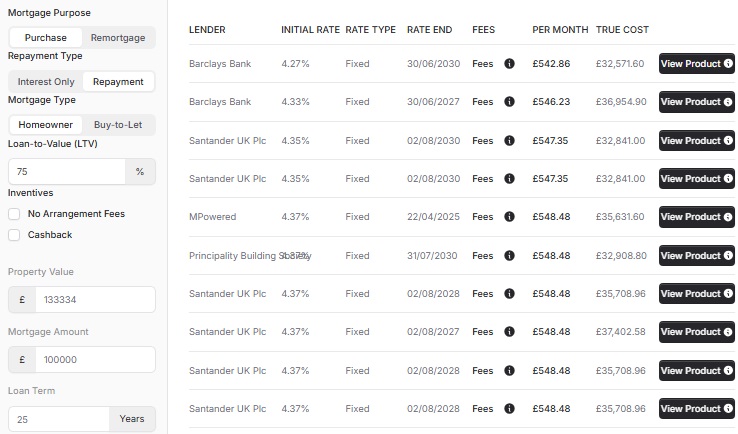

We at Cyborg Finance have already started to notice the ripple effects of this hopeful news. Over the past week, our inbox has been overflowing with news from various mortgage lenders announcing reductions in mortgage rates due to this positive economic trend.

Predictions for the Bank of England's next session in June are varied. While some experts expect a holding pattern with rates standing at 5.25%, others foresee a potential cut on the horizon. Adding fuel to this speculation, the Bank of England’s deputy governor, Ben Broadbent, recently suggested the possibility of a base rate cut as early as this summer if inflation continues to decline.

If things continue to evolve with its forecasts – forecasts that suggest policy will have to become less restrictive at some point – then it’s [the] possible bank rate could be cut sometime over the summer

Ben Broadbent, Bank of England’s deputy governor.

Significantly, fixed mortgages are reliant on long-term forecasts of the base rate. As such, with inflation steadily aligning with target rates, forecasters are expected to anticipate base rate decreases. Except today's news won't see a plunge in mortgage rates as forecasters have been expecting this news, it's what we call "priced in" to some extent.

If you are a first-time buyer lower mortgage rates help with affordability requirements. Existing homeowners can benefit on remortgage that their payments wont go up high. As landlords keep watching those tight rental yields.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX