Finding the right mortgage deal can be challenging, and if you're considering 95% LTV homeowner remortgages, it's essential to understand the process thoroughly. At Cyborg Finance, we want to help you navigate this process with confidence. Therefore, we've created this comprehensive guide just for you.

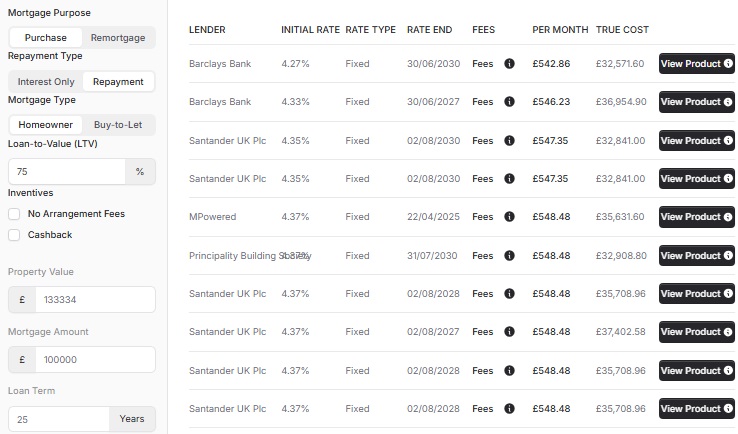

Lowest 95% LTV Remortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

5.25%

5 Year Fixed

TBC

TBC

Fixed

at

5.25%

|

|

|

|

5.28%

5 Year Fixed

TBC

TBC

Fixed

at

5.28%

|

|

|

|

5.41%

5 Year Fixed

TBC

TBC

Fixed

at

5.41%

|

|

|

|

5.44%

5 Year Fixed

TBC

TBC

Fixed

at

5.44%

|

|

|

|

5.51%

2 Year Fixed

TBC

TBC

Fixed

at

5.51%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £105264 property value, a £100000 loan amount and £5264 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

Benefits of 95% LTV Homeowner Remortgages

-

Lower Monthly Payments: One enticing advantage of a 95% LTV remortgage is potentially reducing your monthly repayments compared to your Standard Variable Rate (SVR). This could free up cash flow in your budget, providing more flexibility in your finances.

-

Cash Release: A 95% LTV remortgage might allow you to release equity from your home, freeing up cash for much-needed home improvements or unforeseen expenses. Remember, though, this depends on the value of your property increasing since you initially took your mortgage.

Disadvantages of 95% LTV Homeowner Remortgages

-

Higher Interest Rates: Mortgages with lower LTV rates tend to have lower interest rates. Hence, with a 95% LTV remortgage, you may encounter slightly higher interest rates compared to those with lower LTVs. Higher interest could mean you'll pay more over the mortgage's lifespan.

-

Risk of Negative Equity: With 95% LTV, there's a higher possibility of ending up in negative equity if property values decrease. Negative equity happens when your mortgage's outstanding balance surpasses your property's worth, which could complicate matters if you decide to move or sell your home.

Requirements for 95% LTV Homeowner Remortgages

-

Good Credit Score: A solid credit history and score may increase your chances of being approved for a 95% LTV remortgage. Lenders want to see that you've managed credit responsibly in the past.

-

Proof of Stable Income: You'll need to show ongoing, stable earnings to reassure the lenders that you can meet your mortgage payments.

-

Property Valuing Up: It's critical the value of your property has increased since the initial mortgage. This equity is what you’re essentially ‘unlocking’ with your remortgage.

The Need to Use a Mortgage Adviser

A mortgage adviser's guidance can be instrumental in your remortgage journey. They can help you understand the application process, compare deals, access exclusive rates, and negotiate with lenders on your behalf. Essentially, they will help you find the best possible remortgage deal tailored to your unique circumstances.

At Cyborg Finance, we're ready to help. Contact us today to take the first step in your remortgaging journey.

Reviewed and Approved 01 Jan 2024 by:

CEO, Cyborg Finance

Experienced Director with a demonstrated history of working in the financial services industry. Skilled in Business Planning, Portfolio Management, Business Relationship Management, and Business Development.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX