Remortgage with Hodge

Remortgage with Hodge

2 Ways to Remortgage with Hodge

Hodge has two types of remortgage products. The first is for existing customers and the other for new customers.

Existing Customer Hodge Remortgage

When your current Hodge deal is coming to an end or if you are on Hodge Variable Rate. You can switch to a new deal with Hodge. You can also borrow more at the same time.

We can switch your mortgage with Hodge. It is quick, with no legal fees or valuation fees. You can even do this a few months before your current rate expires.

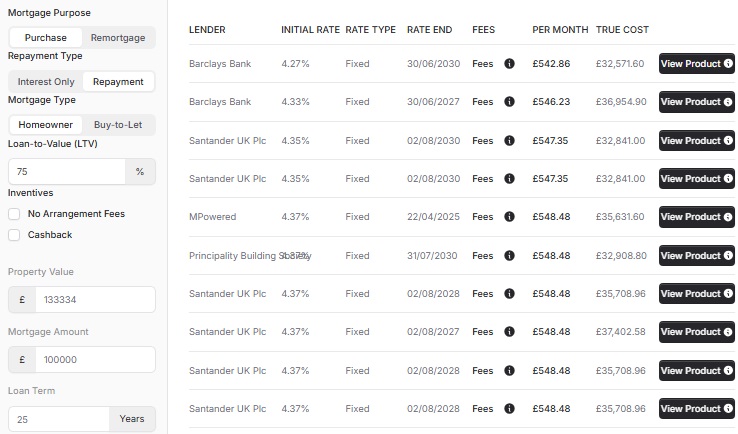

But... Hodge often prices existing customer mortgages at a higher rate than a remortgage. It's better to compare Hodge to the 90+ Other lenders. It is free with Cyborg Finance.

New Customer Hodge Remortgage

You could save money by asking us to move your current mortgage to Hodge. You can remortgage if your existing mortgage deal is coming to an end or you are on the lender's Variable Rate.

But... we often have better mortgages with other lenders. That can be a lower mortgage rate or better mortgage features than Hodge. It's better to compare to the 90+ lenders, and it is free with Cyborg Finance.

Hodge Lowest Remortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

5.77%

2 Years Fixed

2

Years

Fixed

at

5.77%

|

|

|

|

5.77%

5 Years Fixed

5

Years

Fixed

at

5.77%

|

|

|

|

5.79%

2 Years Fixed

2

Years

Fixed

at

5.79%

|

|

|

|

5.85%

5 Years Fixed

5

Years

Fixed

at

5.85%

|

|

|

|

5.89%

2 Years Fixed

2

Years

Fixed

at

5.89%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.77%

2 Years Fixed

2

Years

Fixed

at

5.77%

|

|

|

|

5.77%

5 Years Fixed

5

Years

Fixed

at

5.77%

|

|

|

|

5.79%

2 Years Fixed

2

Years

Fixed

at

5.79%

|

|

|

|

5.85%

5 Years Fixed

5

Years

Fixed

at

5.85%

|

|

|

|

5.89%

2 Years Fixed

2

Years

Fixed

at

5.89%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.89%

2 Years Fixed

2

Years

Fixed

at

5.89%

|

|

|

|

6.39%

5 Years Fixed

5

Years

Fixed

at

6.39%

|

|

|

|

5.95%

5 Years Fixed

5

Years

Fixed

at

5.95%

|

|

|

|

6.45%

2 Years Fixed

2

Years

Fixed

at

6.45%

|

|

|

|

6.09%

2 Years Fixed

2

Years

Fixed

at

6.09%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

No products found for your search criteria.

No products found for your search criteria.

No products found for your search criteria.

Why remortgage with a Broker? Not Hodge

ou can remortgage with Hodge direct (dont do that) or via Cyborg Finance. Here are some of the most common reasons to Remortgage with Hodge via Cyborg Finance.

Lower Mortgage Rates than Hodge

We may recommend that you remortgage to Hodge. Except we have over 90+ other mortgage lenders. Mortgage Lenders all competing with Hodge for your business.

A broker at Hodge has several mortgage products to offer you, Cyborg Finance have hundreds.

One of the alternatives available from us could mean lower mortgage rates or lower fees.

Higher Chance of a Mortgage than Hodge

Hodge has set criteria. Suppose you apply to a mortgage from Hodge which is declined. That is the end, no mortgage.

At Cyborg Finance we not only have the Criteria of Hodge. We also have the criteria of 90+ other mortgage lenders. We try to fit you with the best lender that will accept your circumstances on the first try.

If you do get declined, we have all your detail and can try alternative lenders with different criteria or underwriting.

Easier than Hodge

Finding and then completing a mortgage can be a stressful process. Cyborg Finance works for you, its stress-free or at least we try to be.

We can take the administration and handling of the lender away from you. We know what each lender will require from you. Reducing the time spent going back and forth with new requests for information.

More Legal Protection than Hodge

When you receive Mortgage Advice from Cyborg Finance, we have a duty of care to you. We must recommend a suitable mortgage and justify why the mortgage you have chosen is right for you. If our advice is not up to scratch, you can complain and get compensation. Hodge does not recommend the most suitable mortgage available in the market. Just from them.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX