Bank of England Housing Update (May 2024)

Bank Base Rate is stays at 5.25%, Mortgage Rate Up but Housing is looking positive.

With inflation currently at 3.2% and the Bank of England is working to meet its 2% inflation target. At its meeting in May 2024, the Monetary Policy Committee (MPC) voted by a majority of 7-2 to keep the Bank Rate at 5.25%. However, two members favoured reducing the Bank Rate by 0.25 percentage points, bringing it down to 5%.

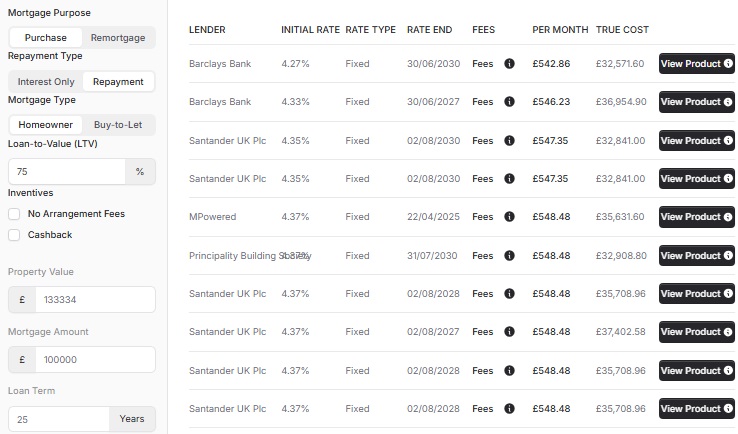

Mortgage rates have increased recently in anticipation of this decision, as previous SWAP rate forecasts believed that the Bank Base Rate would have decreased by now.

This is unfortunate news for

- Remortgaging Homeowners who need to remortgage as their initial rate ends.

- First Time Buyers trying to meet higher affordability requirements.

- Landlords hoping not to increase rents due to increased mortgage costs.

CPI Inflation did decrease from 3.4% Febuary to 3.2% in March but remains above the 2% target. CPI inflation is expected to return to close to the 2% target in the near term, but to increase slightly in the second half of this year.

Bank of England on Housing

Since February, quoted mortgage rates have retraced some of their previous declines, largely reflecting pass-through of increases in risk-free reference rates. They remain substantially below the levels reached last summer, however. According to the latest Moneyfacts data, the number of advertised owner-occupied mortgage products is now back at the levels recorded before the start of the interest rate tightening cycle.

Mortgage lending fell by 0.1%. Lenders reported an increase in demand for secured lending, however, with additional increases expected in the coming quarter. Consistent with this, the housing market has shown further signs of recovery and, though still weaker than their pre-pandemic averages, mortgage approvals for house purchase increased for the sixth consecutive month in March.

House prices have been flat for the past year but show signs of a return to growth. Higher incomes and improved sentiment among households are also likely to be supportive of the housing market.

The more recent pickup in mortgage approvals should, however, translate to higher housing transactions. The monthly RICS balances for new buyer enquiries and instructions to sell have also recently returned to positive territory, indicative of increased activity within the housing market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX