Bank of England Housing Update (September 2024)

Bank Base Rate is stays at 5.25% but Housing is looking positive.

At its meeting on September 19th, 2024, the Monetary Policy Committee (MPC) voted by a majority of 8 to 1 to keep the Bank Rate to 5.00%. However, 1 member (Dr. Swati Dhingra) preferred to reduce Bank Rate to 4.75%.

At the previous MPC meeting in August they decided to reduce the bank base rate to 5.00% . The next Monetary Policy Committee (MPC) meeting is on the 7th of November.

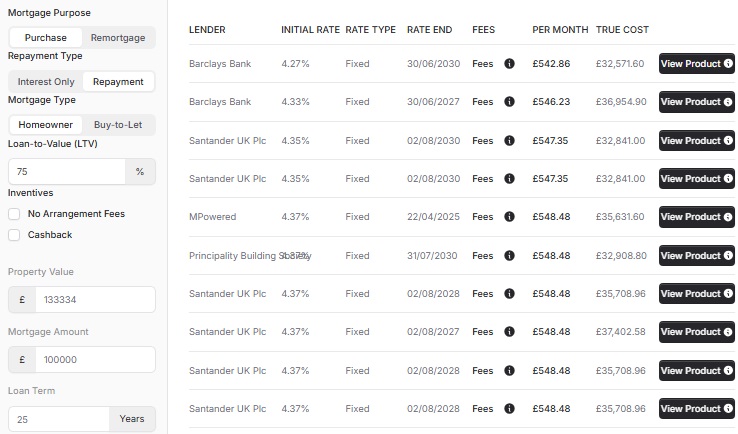

Fixed Rate Mortgage rates have decreased in anticipation of this decision not to increase the Bank Base Rate.

This is good news for

- Remortgaging Homeowners who need to remortgage as their initial rate ends.

- First Time Buyers trying to meet higher affordability requirements.

- Landlords hoping not to increase rents due to increased mortgage costs.

The US central bank lowered interest rates (by 0.5 percentage points) for the first time in four years, last week. The Federal Reserve reduced the key lending rate to a range of 4.75% to 5%.

Inflation

Inflation is at 2.2%, the Bank of England CPI Inflation increased from 2% in August to slightly above the target of 2%.

Bank of England on Housing

mortgage rates had fallen since the MPC’s previous meeting broadly in line with declines in risk-free reference rates.

The share of two-year fixed-rate mortgages within new secured household lending had been increasing since 2023 Q1, despite rates on these mortgages being above five-year fixed rates over this period. That had reversed the previous trend whereby longer-duration mortgage fixes had increased in popularity since 2016, probably reflecting household expectations of lower interest rates. Slow mortgage stock turnover meant that the share of five-year fixed-rate mortgages in outstanding lending had remained historically high.

Bank of England on Renting

TBC, as the report is published.

Bank of England on Housing Investment

TBC, as the report is published.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- hello@cyborg.finance

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX